Measuring the Potential Impact of COVID-19

Traveler Sentiment From Destination Analysts, December 14, 2020.

Key Findings to Know this Week

- Anxieties about the coronavirus are severely impacting travel sentiment for the near-term

- Americans’ travel mindset is now evenly split between readiness and hesitation with half of Americans needing a little or a lot more time to feel ready to travel

- This week, 55% of Americans said they would feel guilty traveling right now and 50% have lost interest in traveling for the time being—last week only 43% felt this way

- Nearly six in 10 (58%) feel travel should be limited to essential needs only and 55% agree they do not want travelers coming to their own communities right now

- As a result, Americans are pushing out their travel intentions into at least Q2 of 2021

- Two-thirds of Americans say the current pandemic situation makes them less likely to travel over the next three months

- Yet, progress with the vaccines is appearing to have a positive impact.

- 59% of Americans feel that the vaccine developments make them more optimistic about life returning to normal in the next six months, while 51% say the vaccines makes them more optimistic they can travel safely by then

- As Americans continue to exhibit receptivity to travel marketing for future trips, half of American travelers expressed excitement about taking a getaway soon

- Of those who have recently recalled seeing a travel advertisement, 57% report the ad made them feel happy or very happy

- Looking at the recovery of the meetings industry, the percent of American travelers who have at least tentative plans to attend a convention or conference in the next year has risen to 24% from 16% two months ago

Source: Destination Analysts

From H2R Research, October 1, 2020:

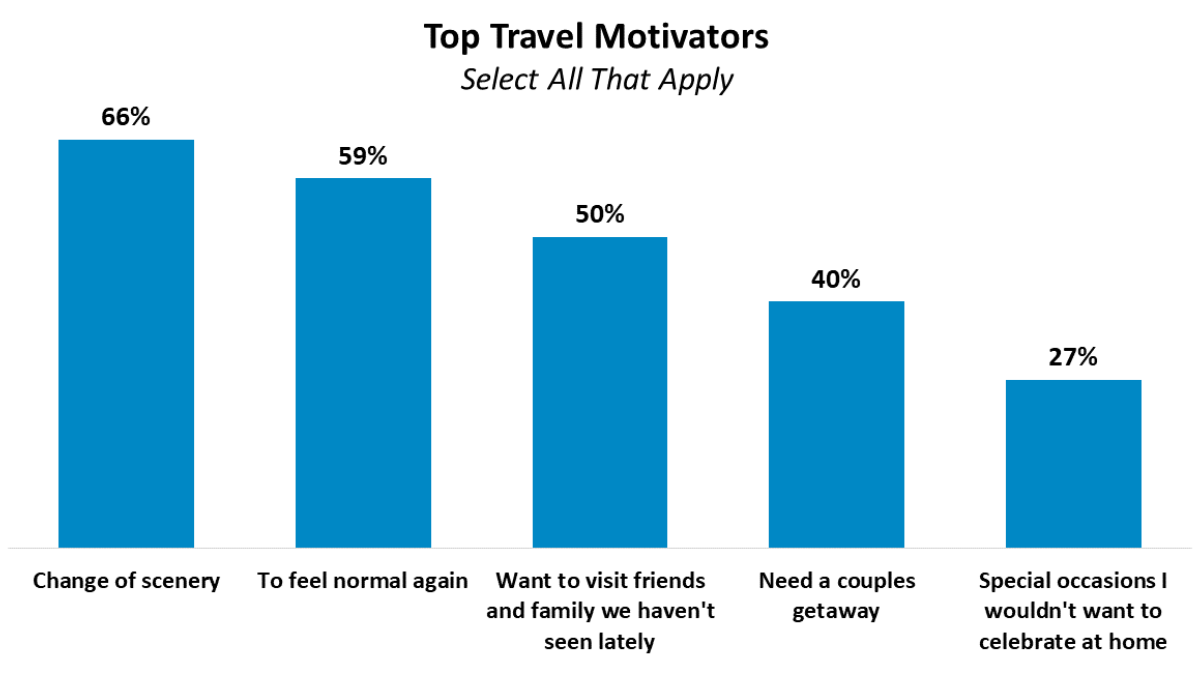

It has been nearly seven months that the United States has been battling the coronavirus pandemic, and while many things have changed in these past seven months there is also a lot that has stayed the same. The desire for life to return to normal has been one of those constants, as has the need for a change of scenery. And those sentiments continue to be the biggest motivators of travel.

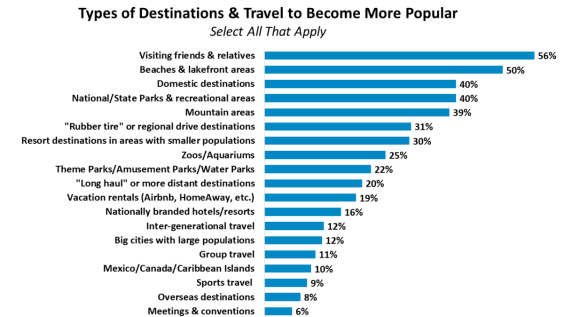

People need travel. It is not just a fantasy or a luxury, but it is fundamental desire to most of our normal lives—the normalcy everyone is craving right now. Consumers also have an essential need for connectedness with one another. Linking these two basic needs together makes it come as little surprise that nearly six in ten consumers believe travel to visit friends and family will become the most popular type of travel in the coming years.

Consumers also expect outdoor destinations to become increasingly popular in the near future. Beaches and lakes, national and state parks and mountainous areas can all expect to recover a bit quicker than long haul travel, meetings and conventions, group travel and visitation to big cities with large populations.

The types of lodging consumers are leaning toward are also shifting during these unusual times. Nationally branded hotels and resorts edge out vacation rentals like Airbnb, and rural or suburban areas are expected to be the trendy choice over the once booming urban locations. And when staying overnight on a trip, consumers are most interested in having food and beverage options on site, a pool and transparent cleaning protocols.

Early Adopters who have already ventured out and taken a leisure trip indicate they are most satisfied with the communication provided by the attraction or destination beforehand regarding what specific actions were being employed and how those additional safety precautions aligned with guest expectations. Strong communications upfront that transparently describe what measures have been put into place help consumers feel more at ease during their visit.

As time moves on, we continue to see an increase in the number of Early Adopters venturing out. This week, nearly one-quarter of consumers indicated they have ventured out by traveling for leisure or visiting an attraction of some sort (up 24% from mid-September). Early Adopters are critical to please as their experiences and social media narratives dictate how soon other travelers will follow their lead.

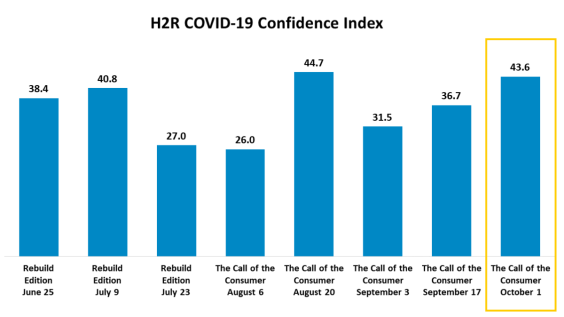

And the good news is, this week’s COVID-19 Confidence Index improved for the third straight wave of findings, coming in at 43.6. Both of these increases are positive signs the country is beginning to head towards the “next normal.”

More information: www.h2rmarketresearch.com/covid-19-subscribe

This data reflects the fourth wave of H2R’s COVID-19 Travel & Attractions Update: Rebuild Edition conducted the week of September 28, 2020, from a nationwide, professionally managed panel of consumers. 225 responses were collected for this wave, providing for a maximum margin of error of +/-6.5%. For more information, please email info@h2rmarketresearch.com.

Traveler and Consumer Sentiment Survey Results

Back-to-Normal Barometer

October 14, 2020

- A vaccine or therapeutic treatments to mitigate the effects of COVID-19 provide the most reassurance for travelers to feel comfortable staying in a hotel or flying again

- Nearly one-third (34%) of travelers would be much more likely to fly domestically if all passengers and employees tested negative for COVID-19 immediately prior to flying

- One-quarter of travelers (26%) would be much more likely to attend a conference if all attendees and employees tested negative for COVID-19

- Six in 10 strongly agree that their employers should make it easy to obtain a COVID-19 vaccine once available

- Nearly six in 10 (58%) are strongly concerned that there will be a second wave of COVID-19 outbreaks requiring event cancellations and lockdowns this year

- Yet less than half (49%) said that they will definitely get a COVID-19 vaccine when it becomes available

Source: Engagious

National Tracking Poll: COVID-19 and Travel Sentiment

December 8, 2020

- As the coronavirus continues to surge, 15% of American travelers have cancelled their holiday travel plans in just the past two weeks and nearly half (46%) have no plans to travel

- Four in 10 (41%) of travelers indicated that they do not plan to travel until a vaccine is available, down slightly from 44% two weeks ago

- Despite a vaccine being imminent, 74% of American travelers still expect to change their travel plans in some way due to COVID-19 within the next six months

- Still, 62% of travelers indicate they have travel plans within the next six months, holding steady from two weeks ago

Source: Longwoods International supported by Miles Partnership

The Harris Poll CV-19 Tracker

December 11 and 16, 2020

- Just one in five Americans (21%) are planning on attending an in-person gathering for Christmas this year and 14% say they will be hosting an in-person gathering

- Three quarters say they are not likely to travel for Christmas this year and more than two in five Americans (43%) have changed their Christmas plans in the past few weeks

- Of those who changed plans, more than half (55%) altered the number of people they will be celebrating with

- One-quarter of Americans are planning on celebrating Christmas virtually this year

- If companies allow a permanent work-from-home option, half of Americans say they would be likely to relocate elsewhere

- Half of Americans (50%) would choose to relocate closer to family and friends, while (45%) would be near a beach

Source: The Harris Poll

Travel Intentions Pulse Survey (TIPS)

December 7, 2020

- The percentage of respondents likely to take a domestic leisure trip during the next six months remained steady (41%) after the six-point decline observed between September and October

- The percentage of respondents likely to take a domestic business trip during the next six months increased to 38% from 34% in October

- One in five (20%) of business travelers are likely to attend a conference or convention, up from 17% last month and one in four are likely to attend a business meeting

- Travel by car remains the most preferred form of transportation for respondents: One in five (20%) are willing to drive more than 500 miles for a leisure trip

- The percentage of respondents likely to travel by personal car during the next six months rose to 67% following a two-month decline

Source: MMGY Travel Intelligence

Consumer Behavior in the Time of COVID-19

October 31, 2020

- As concerns over the coronavirus remain high, there are few signs of individual behaviors changing

- The number of Americans that have visited friends or relatives (49%), gone out to eat (42%) and self-quarantined (14%) is stable compared to the past few weeks

- Concerns are emerging about the holiday season, with two-thirds (68%) making adaptations to how they will celebrate and changing how they view holiday travel

- Two-thirds say traveling for the upcoming holidays poses a large or moderate risk

- More than half of Americans (54%) have begun to make plans about how they will celebrate the holiday season

- The most common adaptation for Thanksgiving celebrations are having a smaller gathering (35%) and not seeing family or friends they normally would (21%)

- A slim majority, 52%, say they are celebrating Thanksgiving this year with just their immediate family. More than one in 10 (14%) are not planning to celebrate at all

Source: Ipsos

iMeet Survey of Meeting Planners

November 15, 2020

- With the recent promising vaccine news, many planners are hopeful as they look to 2021. The percentage of planners with a request for proposal in progress and with at least one future face-to-face meeting booked or contracted both increased this week to 49% and 75%, respectively

- 68% of meeting planners anticipate they will resume face-to-face meetings sometime in 2021, with half not planning on meeting until Q2 (27%) or Q3 (21%)

- Yet, uncertainty about when to resume face-to-face events continues to increase and reached 21% this week, up from 18% the prior week

Source: iMeet

Fall Travel Index

September 8, 2020

- While Florida and Arizona have always been popular destinations, there is significant y/y increase in travelers planning to visit this fall

- Travelers are looking for short, last minute getaways with 55% booking two to five-night stays and often booking less than a week in advance

Source: Tripadvisor

Optimism for Travel in 2021 Growing

December 10, 2020

- Though consumer confidence in travel varies by country and generation, one in two travelers feel optimistic—comfortable or even excited—about taking a trip in the next 12 months

- Global travelers said that they are more likely to take trips between April and September 2021

- Health, safety, flexibility and financial peace of mind are essential. Three-quarters of travelers said measures such as mask enforcement, reduced capacity or contactless services and flexible cancellation policies will inform where they stay on their next trip

- Seven in 10 travelers want added flexibility, such as travel insurance and trip protection, full cancellations and refunds on transportation and accommodations

- Close to six in 10 (57%) travelers said they would be comfortable traveling if a vaccine is widely available, which is promising given that this sentiment was captured prior to recent positive vaccine news

Source: Expedia Group Media Solutions

Home for the Holidays

December 15, 2020

- While nearly 85 million Americans plan to travel from December 23 through January 3, that is 34 million fewer travelers than 2019, a decline of at least 29%

- Of those traveling, more than nine in 10 will travel by car, a decline of at least 25% compared to last year

- Auto travel will likely replace some trips previously taken by air, bus or train

- Holiday travelers are continuing to take a wait-and-see approach to their travel decisions which will likely result in last minute cancellations

Source: AAA

Business Travel and Meetings Expected to Surge the Second Half of 2021

December 17, 2020

- Three out of four respondents expect employees to attend in-person meetings/events in Q2 or Q3 2021

- Sales meetings with customers and prospects will be the priority for the year ahead

- Three in five members of the Global Business Travel Association (GBTA) say vaccine availability is a ‘significant’ factor in their company’s decision to resume business travel

- Despite the vaccine being rolled out in the U.S. over the past few weeks, 54% of GBTA member companies remain unsure about their position concerning vaccine availability and the resumption of business travel

- However, one in five say their employees will be permitted to travel for work when a significant portion of the population have been vaccinated

- Just over one-third (36%) of North American respondents say their company has begun planning 2021 meetings and/or events

- Of those who report their company is planning to host/attend 2021 meetings and/or events, more than half are planning small to mid-sized meetings or events with up to 500 attendees

- As attendance at in-person events increase through the year, hybrid meeting attendance is expected to decline as 2021 unfolds

Source: Global Business Travel Association

2021 Global Meetings and Events Forecast

- North American respondents estimated that 24% of their events in 2021 will include a virtual component and will be smaller local events with fewer than 25 attendees that require no air travel or lodging

- The top two factors influencing whether to hold an in-person event are confidence in attendee health and safety components (68%) and flexible cancellation and attrition terms (59%)

- The capacity to socially distance and disinfectant protocols are top factors influencing meeting location decisions

- Meeting length is anticipated to be longest for in-person incentives/special events, at 3.6 days on average, while the longest type of hybrid meeting is predicted to be conferences/trade shows, at an average of 9.7 hours

- Almost two-thirds predict that overall meeting spend will be down and the total cost per attendee per day will be down for every meeting type

- The top five meeting destinations in the U.S. in 2021 are expected to be Orlando, Las Vegas, New York City, Washington D.C. and Dallas

Source: American Express Global Business Travel

Current Events Bring Guarded Optimism for Industry Recovery

November 24, 2020

- Likely as a result of the recent vaccine news and election results, planners feel more hopeful than in October—43% reported feeling hopeful compared to 33% in October, while 38% of suppliers expressed the same amount of hope as they did in October

- A higher percentage of planners are designing live experiences in post-COVID-19 physical environments: 66% vs. 57% last month, suggesting that planners are preparing for hybrid as well as digital events

- Likely in response to the spikes in COVID-19 cases across the U.S., both planners and suppliers are less inclined to travel to a business event until there is a widely distributed vaccine

- Nearly 40% of planners and 27% of suppliers would not travel—up from 33% and 18%, respectively, the prior month

- Nearly one-quarter (23%) of suppliers did not feel that in-person events are a viable option for most groups. In addition, 34% of planners who have attended an in-person event were convinced that it would not work for groups—up from 30% the prior month

Source: PCMA

Thanksgiving Travel

December 9, 2020

- Nearly one-quarter (22%) of Americans were not at their place of residence on November 26 according to mobile phone location data

- Approximately one in eight individuals traveled more than 30 miles away from home

- Americans who live in the West and Northeast were more likely to be away from home, while many parts of the South saw a relatively larger number of non-locals on Thanksgiving Day

Source: Bloomberg